If you lived in Japan during a year in which you were considered a “non-permanent resident” for part of the year, you are required to attach a document called the “Confirmation of the Type of Resident Status, etc.” when filing your Japanese income tax return. This form helps clarify your resident status and the scope of your taxable income in Japan. It includes information such as your nationality and the periods during which you had a residence or place to stay in Japan.

This explanation focuses on how to correctly fill out the “Confirmation Table of the Period of Resident Status” section of the form.

Form Link – Japanese National Tax Agency (NTA)

1. How to confirm the period you lived in Japan within the past 10 years

If you have your passports from the relevant period, you can use the entry and exit stamps to confirm how long you stayed in Japan during the past 10 years.

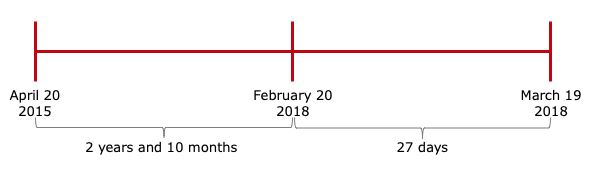

When calculating your period of residence, do not include the day you entered Japan. For example, if you arrived on April 20, 2015, and left on March 19, 2018, the calculation would start from April 21, 2015. Here’s how to break it down:

From April 21, 2015, to February 20, 2018 = 2 years and 10 months

From February 21, 2018, to March 19, 2018 = 27 days

So you would write: 2 years, 10 months, and 27 days in total.

2. If you entered and left Japan multiple times

If you came and left Japan several times during the past 10 years, calculate each stay separately using the same method. Then, total the years, months, and days across all periods.

When adding up:

30 days = 1 month

12 months = 1 year

These totals help determine your official resident status for tax purposes.

3. Alternative to filling in the table

Instead of completing the table, you can choose to attach a copy of the relevant pages of your passport that show your entry and exit records.

YouTube

Spotify

If you have any questions, please feel free to reach out.

For more information about the prices of the services we offer, please refer to this article.